At the beginning of last week, the bitcoin (BTC) price formed a so-called breakout pattern, after which it plunged down from $10,300 to $10,000 on Monday afternoon. After recovering in the evening, bitcoin traded mostly sideways on both Tuesday and Wednesday. Thursday morning, the most dominant cryptocurrency fell below the psychological limit of $10,000. At the end of the day, however, a major rally took place, bringing the bitcoin exchange rate back well above $10,000. After the exchange rate reached the resistance of $10,300, BTC found support on the $10,200 on Friday morning. Over the weekend, bitcoin continued the downward trend of the past few days, finding support at $9,800 on Sunday. After a slight decline on Monday, BTC traded around $9,800 again this morning. At the time of writing, bitcoin is worth $9,589 on CoinMarketCap, after having dropped 3.33% in the last 24 hours.

The long awaited trading platform of the Intercontinental Exchange (ICE), Bakkt, finally went live on Sunday on Monday. However, the launch of the first platform on the market to buy physical bitcoin futures did not have the effect on the price of bitcoin that many people were hoping for. The trading volume on the platform has so far been rather small, which means that the volume has hardly any effect on the price. The CEO of ICE, Jeff Sprecher, said last Sunday that it can take weeks or even months before Wall Street can make a thorough judgement about the platform.

Last Tuesday the American Securities and Exchange Commission (SEC) announced that the Chicago Board Options Exchange (CBOE) has withdrawn the application of the bitcoin exchange-traded fund (ETF) of VanEck and SolidX. Neither the SEC nor the CBOE has indicated why the application has been withdrawn. In related news, Hester Peirce, commissioner of the SEC, announced last week that the future of cryptocurrency may be in Asia and not in the United States.

Binance.US, the US subsidiary of cryptocurrency exchange Binance, opened its doors today. Last week, Americans were already able to register on the platform specifically designed to comply with the regulations in force there. It was also possible to deposit the cryptocurrencies bitcoin, ethereum, bitcoin cash, ripple, litecoin, binance coin and tether. These crypto-currencies could be traded on Binance.US as of today at 15:00 hours. Yesterday it was announced that cardano (ADA), basic attention token (BAT), stellar (XLM), 0x (ZRX) and ethereum classic (ETC) will soon be added to the platform.

ING has conducted a survey among 12,813 Europeans and concludes that the sentiment around cryptocurrency seems to be slowly becoming friendlier, but that people are still insisting on cash. According to the bank, regulatory uncertainties and practical applicability in everyday life hamper the path to mainstream.

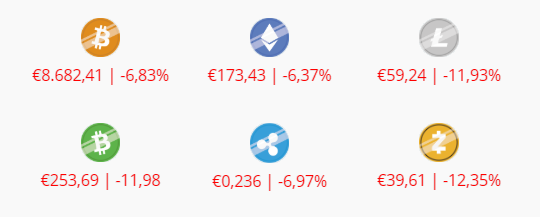

Price changes over the last 7 days

Leave A Comment