Didn’t keep up with the news from the world of blockchain and cryptocurrency last week? No problem, we’ll discuss the main features below.

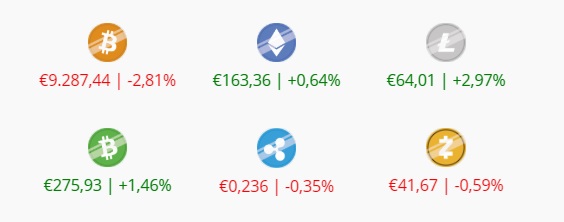

After the price of bitcoin (BTC) didn’t show much price action for a couple of days, the price rose considerably at the beginning of last week. With this, the price managed to break out above the psychological limit of $10,000, then break the resistance at $10,500 and move closer to $11,000 on Wednesday morning. On the way to this milestone, however, the $10,700 resistance turned out to be too strong. Despite this, bitcoin dominance continued to increase due to the poor performance of the altcoins. On Friday, bitcoin seemed to continue to rise for a while, but then went down and broke a number of important support levels. After a slight recovery over the weekend, bitcoin started to decline. At the time of writing, the most dominant cryptocurrency was trading around $10,240 after having lost 1.8% in value in the last 24 hours.

There is a lot of speculation about the cause of the price fall that took place at the end of last week. It is mentioned that it was remarkable that the decline started after the launch of the custody service of trading platform Bakkt. Last Friday Bakkt Warehouse opened its doors to investors who want to deposit their bitcoins in the run-up to the actual launch on 23 September. From that date Bakkt is allowed to offer contracts. The deposited bitcoins are reportedly covered by an insurance policy of $125 million.

Also around VanEck and SolidX it is all but quiet. Despite the fact that the decision on the application for an exchange-traded fund (ETF) has not yet been made, the two companies are going to sell shares in an ETF via a detour. According to guidelines from the Securities and Exchange Commission (SEC), this would be permitted under certain circumstances.

Binance US, the trading platform of cryptocurrency exchange Binance, which is specifically aimed at the US market, is said to be launched in the coming weeks. Customers will soon be able to go through the Know Your Customer (KYC) process in the run-up to the launch. It seems that this process will be very thorough due to the strict regulations in America.

Then there is news from the Netherlands. In a press release dated 3 September, the Dutch Central Bank announced that it would be placing crypto service providers under supervision. According to reports, the regulations, which are the result of new European directives against money laundering, will be in force as of 10 January 2020.

Price changes over the last 7 days

Leave A Comment