At the beginning of last week, the bitcoin (BTC) price managed to rise again, after support held at $7,700. This allowed the most dominant cryptocurrency to rise above $8,000 on Monday. The bulls also managed to push the price through $8,100 and $8,300, after which the price on Tuesday morning was just above $8,400. The rise continued for a while, but the resistance at $8,500 turned out to be too strong. This caused the price to fall back towards support at $8,200. Thursday morning the price had risen slightly again and bitcoin was trading just above $8,300. Nevertheless bitcoin started a descent again and slowly but surely the price was heading for the $8,000. On Saturday morning, bitcoin even traded just below this price level, after having dropped just over 2% in value in 24 hours. The decline continued for a while and yesterday reached a monthly low of $7,776. At the time of writing, bitcoin is trading for $8,235 after having fallen 0.88% in the last 24 hours.

There is again news about Facebooks Libra. For example, PayPal has indicated that it is withdrawing from the Libra Association, the organization that should oversee Facebook’s cryptocurency. Facebook itself has also confirmed this news. Facebook also made the news because of leaked audio fragments in which Mark Zuckerberg, CEO of the company, spoke about Libra. In the conversation, in which Zuckerberg spoke to his employees about Libra behind closed doors, he talked about Libra’s goal and stated that tests are already being conducted in India and Mexico, among other places. He also indicated that Libra was deliberately announced early so that there could be a “consultative approach” and not a sudden roll-out of the crypto coin. The July hearings would have been part of this.

Payment processor BitPay has indicated to cooperate with Ripple’s Xpring. As a result, BitPay customers will be able to accept ripple (XRP) as a means of payment as well as bitcoin, bitcoin cash (BCH) and ethereum (ETH) by the end of this year.

The Securities and Exchange Commission (SEC) has confirmed in a letter that bitcoin is not considered to be a security. Despite the fact that the letter, which was a response to a company that wanted to register as an investment company, is not a binding statement, it is a positive signal that the SEC has publicly stated that it does not consider bitcoin to be an effect.

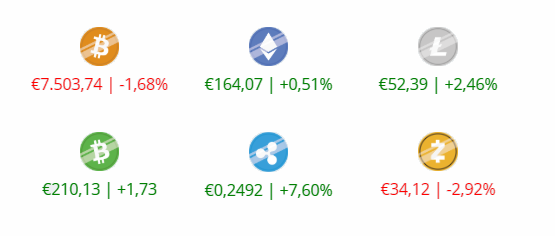

Price changes over the last 7 days